Lamina Loans Things To Know Before You Get This

Direct debt consolidation loans allow debtors to combine several government pupil car loans right into one loan with a set rate of interest rate. The brand-new rate is based upon the standard of all the financings being consolidated. As the Department of Education says, there's no price for this process. And loan consolidation can enable debtors to roll numerous loans into one easier-to-remember payment.

For instance, customers may finish up paying more in interest than they would certainly have otherwise. Combining finances could also eliminate benefits, such as passion rate discounts, major refunds, and also qualification for financing mercy or cancellation. You might have stumbled upon information regarding various other kinds of federal loans, such as Perkins Loans, the Federal Family Education Financing (FFEL) Program and also the Health And Wellness Education Support Funding (HEAL) Program.

When you have owned a home for a while as well as you have actually developed up some equity by making settlements, you can then obtain a loan called a credit line. This kind of finance allows you to access the funds whenever it is required. This item is an useful as well as imaginative method to manage your cash money as the money can be made use of for basically anything and repaid on your terms.

How Lamina Loans can Save You Time, Stress, and Money.

Nevertheless, they can be really pricey if the equilibrium of the line of credit history is not regularly lowered as it can have greater rates of interest and also minimize the equity in your home.

A credit line is like a credit report card, meaning that it is essentially a pool of cash. You can borrow what you need when you require it as well as make settlements just on what you utilize. Although this is a wonderful way for businesses to access the capital they need as needed, lines of credit report typically have high compounded rate of interest prices.

The Buzz on Lamina Loans

If you can fulfill a couple of simple qualifications, you can get the money you need in as low as 24 hr, transferred right into your company checking account. Repayment terms can be personalized according to your certain scenario. As you can see, there are several ways to raise the funding you require to grow your organization.

Talk with a CIBC consultant for information concerning CIBC financing products. Personal financing items as well as residential home mortgages supplied by CIBC are subject to CIBC's lending requirements and credit report approval.

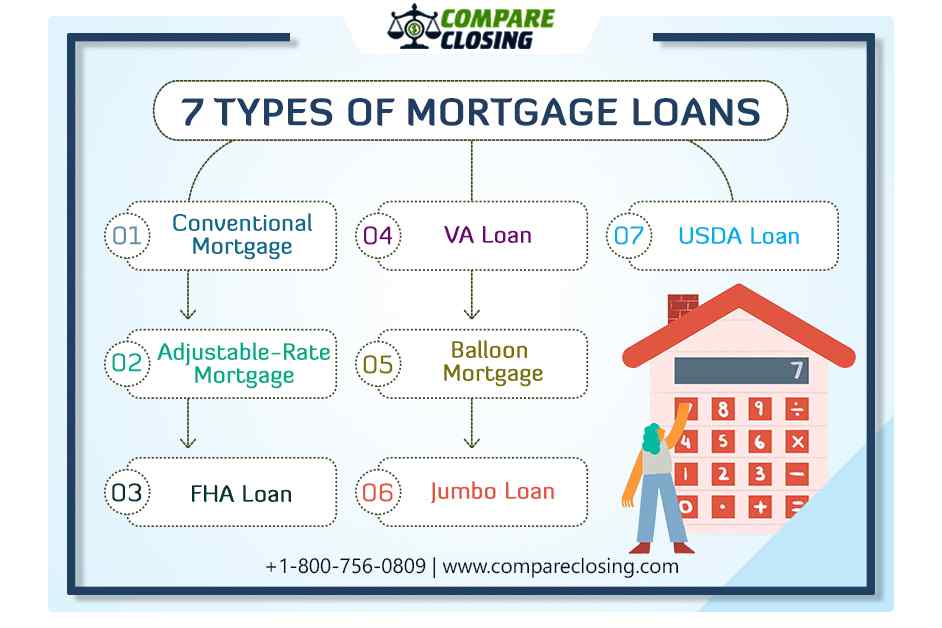

Financially, financings are structured in between individuals, groups, and/or companies when a single person or entity offers money to an additional with the assumption of having it repaid, usually with passion, within a certain quantity of time. banks frequently financing money to individuals with excellent debt who are looking to purchase a cars and truck or residence, or begin a service, as well as debtors repay this cash over a collection amount of time.

Not known Details About Lamina Loans

It is feasible for people to provide small sections of money to countless others via peer-to-peer loaning exchange solutions like Lending Club, and it is common for a single person to car loan another money for small purchases - Lamina Loans. Exactly how a finance is dealt with legally differs according to the kind of loan, such as a home mortgage, as well as the terms discovered in a funding contract.

Federal legislations are laid out to safeguard both financial institutions as well as debtors from financial harm. Though people regularly obtain and also lend on smaller ranges without contract or cosigned promissory note, it is constantly advisable to have a written financing arrangement, as financial disagreements can be worked out a lot more quickly and also fairly with a composed contract than with an oral contract.

It is necessary to comprehend them before obtaining or check my blog offering. Principal: The quantity borrowed that has yet to be paid back, minus any kind of passion. If someone has taken out a $5,000 loan and also paid back $3,000, the principal is $2,000. It does not consider any kind of rate of interest that could be due on top of the remaining $2,000 owed.

Lamina Loans - The Facts

Passion payments substantially incentivize financial institutions to tackle the financial threat of offering money, as the suitable circumstance causes a creditor making back all the cash lent, plus some percent above that; this produces a good return on investment (ROI) - Lamina Loans. Interest Price: The price at which a portion of the principal the quantity of a car loan yet owed is paid back, with passion, within a certain amount of time.

Pre-qualified: Pre-qualification for a lending is a declaration from a financial organization that gives a non-binding and also approximate estimate of the quantity a person is qualified to borrow. Down Repayment: Cash a borrower offers to a lender upfront as part of an initial financing payment. A 20% deposit on a residence that is valued at $213,000 would be $42,600 in cash; the mortgage lending would cover the continuing to be prices as well as be paid back, with passion, over time.

Some loan providers in fact punish customers with a passion cost for very early settlement as it causes lenders to shed out on passion costs they may have had the ability to make had the consumer kept the funding for a longer time. Foreclosure: The legal right and also procedure a lending institution utilizes to redeem monetary losses sustained from having a borrower fail to pay back a car loan; typically causes a public auction of the asset that was used for collateral, with profits going toward the mortgage financial debt.

Getting The Lamina Loans To Work

There are 2 major groups of funding debt. Open-end credit often recognized as "rotating credit report" is Bonuses credit scores that can be obtained from greater than when. It's "open" for ongoing loaning. The most common form of open-end credit rating is a charge card; a person with a $5,000 limit on a bank card can continue to borrow from that credit line indefinitely, provided she settles the card regular monthly and hence never fulfills or exceeds the card's restriction, whereupon there is no more cash for her to obtain.

When you can try these out a repaired amount of money is lent in full with the agreement that it be repaid completely at a later date, this is a form of closed-end credit scores; it is likewise known as a term loan. If a person with a closed-end home loan of $150,000 has actually repaid $70,000 to the loan provider, it does not imply that he has another $70,000 out of $150,000 to borrow from; it merely implies he is a section of the way through his settlement of the complete financing amount he currently obtained as well as made use of.

Loans can either be safeguarded or unprotected. Unsecured fundings are not connected to properties, meaning lenders can not place a lien on a possession to recoup monetary losses on the occasion that a debtor defaults on a loan (Lamina Loans). Applications for unprotected loans are rather approved or rejected according to a consumer's earnings, credit rating, as well as credit report.

Comments on “The 6-Second Trick For Lamina Loans”